Table of contents

- The First lesson: The poor and the middle-class work for money. The rich have money to work for them.

- The Second Lesson: Financial literacy is important to becoming rich.

- The Third Lesson: Mind your own business.

- The Fourth lesson: Use corporations and various other tax loopholes to your advantage and focus on building a good financial IQ.

- The Fifth lesson: The rich invent money.

- The Sixth Lesson: Work to learn — Don’t work for money.

- The Seventh Lesson: Overcoming Obstacles.

- The Eighth Lesson: Getting Started. Nurturing the Right Mindset.

- A To-Do List and an Endnote:

Just wanted to put this out there. After reading a ton of books on finance and investing, Rich Dad Poor Dad looks like a really simple book with straightforward knowledge of finance that is pretty basic, but you got to this from a perspective of an absolute newbie to finance. It is quite insightful if you’re new to it and this book helps ignite that fuel to learn and delve more into finance.

Seek wealth, not money or status. Wealth is having assets that earn while you sleep. Money is how we transfer time and wealth. Status is your place in the social hierarchy.

Naval Ravikant

Rich Dad Poor Dad, written by Robert Kiyosaki is the second personal finance book I’ve read and I’d recommend it to anyone who is looking to build a strong foundation for a path to wealth.

This book doesn’t exactly give strategies for becoming rich but more of providing a mindset to developing how to become wealthy. It gives insight into why the difference in money is not what determines who is poor and who is rich. The person’s habits, goals, fears and such play a great role in one’s action.

Money is power, but what is even more important is financial education. Even if you have lost a ton of money and are broke, the knowledge of knowing how to acquire it is what gives you an advantage.

Rich dad shares, “Making quick decisions is a very important skill, not only for becoming rich but for better outcome of life as well.” Life keeps pushing us around, telling us to learn new things. Instead of blaming someone else or even yourself, learn from what life chooses to give us and learn to get a move out of it.

Feel free to use the links below to read the part that you see fit or simply scroll down to read all of it.

The Second Lesson: Financial literacy is important to becoming rich.

The Eighth Lesson: Getting Started. Nurturing the Right Mindset.

The First lesson: The poor and the middle-class work for money. The rich have money to work for them.

People often play the rat race. The rat race here refers to the endless cycle of waking up, going to work, getting a paycheck, clearing their bills and repeating the same thing over and over. The main reason why this happens to almost everyone is because of two emotions that run our lives. Fear and Desire/Greed.

The fear of not being able to earn money to live a good life, not being able to pay all the bills, not being able to provide good shelter to their family or even the fear of losing the money they’ve earned is what causes them to work day and night without really thinking if it would be to their advantage in the long term.

They keep working until they receive their paycheck and when they do, they are overjoyed and think of all the things that they desire to buy for themselves. This desire makes them work endlessly and traps them eternally.

When people stop learning and stop focusing on self-improvement, that’s when ignorance starts to set in. Ignorance of not thinking things over and letting your emotions take over your decisions.

This is not to say that emotions are bad. Emotions make us humans. Instead of letting your emotions make decisions for you, stop and think for a moment. “Is this to my advantage in the long term? Do I really need this or am I simply trying to impress my friends?”. Think through things properly. Don’t be a slave to money and don’t let it trap you in an endless cycle of a rat race.

Learn how to use emotions to think rather than think with your emotions. As you let yourself be overtaken by your emotions, your intelligence goes down. Our ability to be rational about situations is usually feigned because of our fear and greed caused by our ignorance of what money really is.

Money is an illusion that we’ve allowed ruling over our lives. Out of fear of not having enough of it, we tell ourselves that we need to work hard to get more of it. Instead, we should think things through and break out of the cycle of emotional thoughts.

We usually think of things only from the short-term perspective, will we have enough money to pay this month’s bill, to pay back our debts, etc. Thinking short term is what causes this fear and greed. Thinking long term is an asset of our brain that we usually tend to ignore. Ask yourself, “Why am I forcing myself to work so hard now? Will it even be useful in the next five or ten years?”

Instead of waiting for a paycheck and letting yourself be ruled by your emotions, think and use your imagination of different ways of making money work for you. Making money work for you can be interpreted as finding opportunities to make money without putting in much effort but still not expecting a huge bag of cash. Invest a part of the money you make into things that make money for you and eventually your net worth will keep growing.

The Second Lesson: Financial literacy is important to becoming rich.

It’s not how much money you make but it’s about how much money you keep.

Without having a strong foundation and trying to build a building is the same as trying to get rich without having the proper knowledge of how money works. As boring as accounting may be for some of us, it is one of the most important subjects that’ll help keep yourself updated with how your money is working for you and not against you.

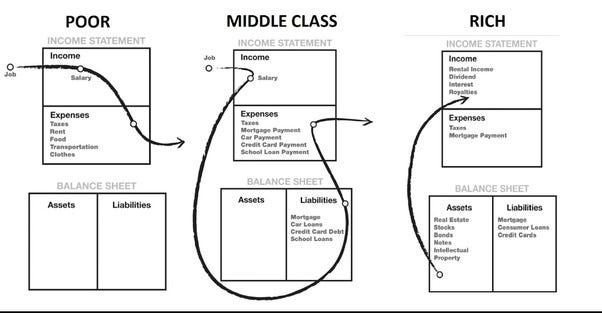

Rule: You must know the difference between an asset and a liability, and buy assets.

Assets add money to your pocket and liabilities take money out of your pocket. The rich acquire assets and the poor acquire liabilities that they think are assets.

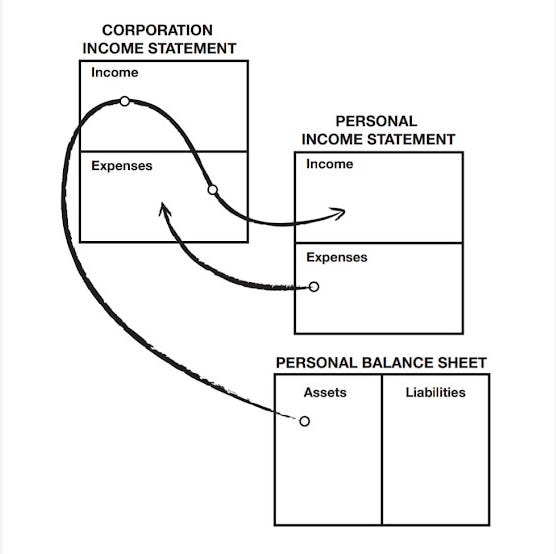

When managing money there are two important things that are to be made while calculating your cash flow — An income statement and a balance sheet.

An income statement balances your income and your expenses, while a balance sheet, well, balances your assets and liabilities. The one famous formula we were taught in fourth grade —

Income - Expenditure = Savings.

Simply convert it into

Income - Savings = Expenditure.

If we want to become rich it is mandatory that we save some part of what we earn.

To buy or rent a house? A highly debatable topic. An insight into what I’ve read is as follows.

The house we own is not an asset as it takes money out of our pocket in the long term in various ways — mortgages, utilities, maintenance, property tax, etc. When buying a new house our liabilities just increase.

Instead of buying a new house and increasing our liabilities, we can invest in building our investment portfolio and building our assets. By buying a house we are missing out on the following — growth of assets that we might have bought earlier, knowledge of building our investment portfolio and increasing our financial literacy.

Even after investing our money and building our assets how do we know that we are rich or wealthy?

Wealth is a person’s ability to survive so many days forward — or, if I stopped working today, how long could I survive?

R Buckminster Fuller

Wealth is a better definition than net worth as the latter is calculated based on how much one values something. The more days you are able to survive ie financial survivability, the more wealthy you are.

The more we invest in our assets, the more income we generate and again reinvest in building our assets the cycle continues. Simultaneously if we are able to control our expenses rather than focusing on how to make more money, we are looking for a solution to a problem that lies within.

The Third Lesson: Mind your own business.

What the author means by this is that instead of focusing on building our income column we should focus on building our assets column. A profession or a job is when we work for someone else, whereas a business is something that builds our assets. What exactly are the assets we should be focused on building instead.

A business where our presence is not required and still earns money for you, if you are working for someone else it is a job then.

Stocks.

Bonds.

Notes (IOU).

Royalties such as music, videos that you own the copyright to.

Other forms of investments that make money for you.

The next topic that the author touches on is our net worth and how it is always less than we expect it to be. Minimize expenses, Tackle Liabilities and focus on building the assets column as early as possible because the thing about money is that it works as an employee 24/7 for you.

Invest in fields that we personally love because that is when we will put in the effort to take care of them and learn more about them. It could be anything from Real Estate to shares and even starting your own company if we are willing to stick to it despite the hardships.

The Fourth lesson: Use corporations and various other tax loopholes to your advantage and focus on building a good financial IQ.

The more we earn money and the more we spend it, the more we are taxed on it. The tax was originally made to take money from the rich and give it to the poor. With time, the plan backfired and the people who voted for it(poor and middle class) are the very ones who are paying it more as compared to the rich.

The rich use corporations and various other loopholes to avoid paying more tax. Corporations are taxed less and they are taxed only on the profit they make, that is why they try to make whatever necessary expenses they can. Employees are taxed on their income, so the amount they can spend is comparatively less.

A corporation is nothing but a piece of legal document that makes a legal body without a soul. It is not a factory, a huge building or a large group of people.

The income your assets make is the income that your corporation makes. The expenses from the corporation are the income you make and the expenses you make are the expenses the corporation makes. This way you and your corporation are paying less tax.

Before getting into the game of money, it is important to know that with more money comes great power and knowledge of how to keep it and how to make it multiply. What is even more important is your financial intelligence or your Financial IQ. Your FIQ consists of four parts:

Accounting. Financial literacy or the ability to read numbers.

Investing. The science of money making money.

Understanding Markets. The science of supply and demand.

Law. Tax Advantages & Protection.

Surround yourself with tax consultants and attorneys. The pay you give them will be comparatively less than paying tax.

The Fifth lesson: The rich invent money.

In this chapter, Robert emphasizes the importance of having Financial Intelligence. Most of us play the easy game or the rat race, work hard, save money and eventually it will pay off. What most of us don’t understand is that it is a strategy that used to work in the past and not anymore.

Most of us have the potential to do great things and the thing that holds us back is self-doubt and a lack of confidence in ourselves, when it comes to money we play it even safer and are even more scared of losing it.

Why should we invest in financial intelligence? Simply because it gives us more opportunities and helps us create our own luck. Often many of us miss out on opportunities because we don’t have the required knowledge or money at the right time.

A great example would have been when the markets were down during the COVID 19 Pandemic at its peak. This was a great time to put in money. Financial Intelligence is also about making our own investments.

A professional Investor is able to look at opportunities that everyone else would look at as risk.

Raises their own money.

Surrounds themselves with people smarter than themselves.

Opportunities are not seen by the eye, they are seen with the mind.

If you know what you are doing then it is not gambling, it is only gambling if you put your money in a deal and you’re just praying. Focus on learning more about your financial environment and building your financial intelligence.

It is what you know is your greatest wealth. It is what you don’t know is your greates risk.

The Sixth Lesson: Work to learn — Don’t work for money.

There is a saying that goes, “A jack of all trades is a master of none”, but what is also true is that, “specialization is for insects.” In today’s world, having numerous skills will always provide better opportunities than those who are specialized only in one field.

The author emphasizes that many of us are very talented but often lack the skills to get rich. He suggests that we work not for the sake of working, but for the experience of learning something new.

The author has switched jobs many times even though each job was very promising in itself. The reason he did it was that he wanted to gain a new learning or a new skill from each of those before he could start his own company.

Most of us fear that if we leave our jobs and go to a new one, we might become financially unstable. While that may be true, the experience we get from the new job will put us in a much better position in the long term.

What are the main management skills required for success? Management of cash flow, management of systems, management of people and most importantly, skills in sales and marketing.

Why sales and marketing though? The author asks a group of students if they can make a hamburger better than McDonald’s and most of them raise their hands and say yes, then he asks them again, then why is it that they are making more money than you.

Using the hamburger analogy, we are all good at producing our respective hamburgers, what we lack is the skill to advertise it and to promote it.

Communication skills are of utmost importance to your success. Knowing how to resolve conflicts, lead people with your voice, writing and much more are essential if you want to go far. The author also talks about the fact of giving more and ye shall receive more. The more you give to the world, i.e. what value can you offer to society, the same value will be returned to you.

The Seventh Lesson: Overcoming Obstacles.

Even after acquiring financial literacy, many fail to become financially independent. They face various obstacles and are unable to face them, they become restricted. The major obstacles faced are:

Fear

Cynicism

Laziness

Bad Habits

Arrogance

Fear. When it comes to money we all like to play it safe. We fear that if we make one false step we might lose it all. The difference between the rich and the poor is the way they handle their fear. It’s okay to be fearful. But the fear of failure and making mistakes and how we view them is what makes the difference.

Winners use mistakes as an opportunity to grow even further whereas losers accept mistakes as a form of defeat. The author talks about how starting as early as possible is an effective strategy for becoming financially independent. By starting early the author tries and refers to the power of compounding.

Cynicism. The self-doubt that we nurture and the doubts that are fed to us by those around us often make us overthink an opportunity and by the time we land on a decision, it’s often too late. The most common path we take is criticism, what we should be doing instead is to be more reasonable.

We often miss out on investment vehicles such as the real estate industry or the stock market because we hear advice from people who haven’t even tried it out for themselves. We get stuck in the “I don’t” loop and never take a step forward.

Make use of whatever opportunity that comes around, start thinking reasonable.

Laziness. The most common form of laziness is keeping oneself busy. By keeping so, they ignore their health and wealth by focusing on low-level activities such as watching TV, internet surfing and such despite knowing that they are ignoring something important. One way to overcome this is to have a little greed.

We have been conditioned since childhood to believe that being greedy is bad. However greed is necessary, when we do so, we have a desire to have something better, something that might potentially make our lives better.

Turn, “I can’t afford it” into, “How do I afford it?“. The former statement puts one in a state of helplessness and despair. It makes one think that they have no choice left. While the latter makes one think of various solutions. It forces the person’s mind to work instead of giving up.

Bad Habits. The bad habit that rich dad mentions here is the one in which a person neglects to pay themselves and only prioritises paying others first.

What rich dad suggests is that we pay ourselves first, using this money to grow our asset column and then pay others and pay our bills. Even if money does come short, the Rich dad explains that it forces him to search for other ways of making income. It motivates him that he needs better ways of making income.

Arrogance. There are many people in the world of investment who talk about things that they have no idea about. It’s not that those people are lying, it’s simply that they are somewhat ignorant. If you don’t know something, take it as an opportunity to educate yourself.

The Eighth Lesson: Getting Started. Nurturing the Right Mindset.

Making new sources of income or simply learning to make it is similar to driving a cycle. It’s wobbly at first but with time it gets easier as you unlock your financial genius within.

The author shares 10 steps that we can use to awaken the financial genius with us.

- Find a reason greater than reality: the power of spirit.

Having a strong emotional reason, a purpose or a goal is an important factor in achieving wealth. A reason or a purpose is a combination of “wants” and “don’t want”. You do something because you want it or because you don’t want to have it holding you back.

- Make daily choices: the power of choice.

We make daily choices with our most valuable asset — time. Instead of making excuses that we don’t have enough time, we’ll learn it later when necessary and such. We can make an effort to make time to learn new things about making money. Learn all about investments before going into investing.

- Choose friends carefully: the power of association.

Motivational speaker Jim Rohn famously said that "We are the average of the five people around us."

We tend to adjust, learn and imitate those with whom we spend the most time. Surround yourself with people who have similar and greater goals as compared to yourself and almost every moment you spend with them can become an opportunity to learn something new.

- Master a formula and then learn a new one: the power of learning quickly.

Be careful with what you learn, you are what you put in your mind. Learning new methods of making money from a reliable source is a good option to get started.

Taking the action of applying that formula is important to see if that method works for you. Keep learning new formulas once the old methods are mastered. The more formulas you know the more approaches you can take to any opportunity you see.

- Pay yourself first: the power of self-discipline.

The one thing that separates the rich, the middle and the poor is their self-discipline. The most important discipline is to “pay yourself first”. It’s easy to say but only a few follow. Building your assets early on is an important factor in getting rich. To pay yourself first:

Don’t get into large debts, keep your expenses as minimal as possible.

At times of high financial pressure, resist the urge to pay bills out of your savings. Search for new ways of making money.

- Pay your brokers well: the power of good advice.

Many of us try to save a bit of money by taking discount brokers or trying to do certain things by ourselves. A good broker should be able to provide you with information and as well as make you money. The fraction of the amount you pay them is comparatively very less as compared to what you earn. Information is priceless. You can learn from people who are more experienced than you are.

- Be an Indian Giver: the power of getting something for nothing.

The term “Indian Giver” was a misunderstanding that arose when the settlers were cold during the night, the Indians would give the person a blanket. The person would mistake it for a gift and would be offended when the Indian asked for it back.

What it basically means is to get back what you invested fully and quickly as possible. The term Return On Investment (ROI) is used here. In how much time can you gain back what you had invested while getting something back for free in the form of an asset.

- Use assets to buy luxuries: the power of focus.

We all love to have luxuries in our life. The mistake that we make is that we buy them by taking loans and increasing our debts. If we were to focus on building our assets and using the cash flow from the assets to buy what we desire it would pay off much better in the long term.

- Choose heroes: the power of myth.

Whenever we were playing a sport or some game, we visualised ourselves as our heroes during our childhood days. Doing so makes it seem like anything is possible. If they can do it then so can I! It’s an ability we tend to lose over time.

Have heroes or mentors, listen to what they have to say and try to understand what they are seeing. In any situation ask yourself what would your hero do here. They make it seem easy in such a way that we get even more inspired.

- Teach and you shall receive: the power of giving.

Rich dad says, "If you want something, you first need to give."

Be it money or a smile, if we were to give it first to others we would receive it in abundance. The same goes for teaching as well, when you teach you start to learn more simultaneously. Remember to give more not to receive anything but simply for the joy of giving to others itself.

A To-Do List and an Endnote:

For those who need the next few steps for what to do and what action to take, try and follow the following list:

Stop doing what you are doing. Insanity is doing the same thing over and over again and expecting different results.

Look for new ideas. Keep learning new things and methods that can help strengthen your financial literacy.

Find someone who has done what you want to. Invite them for lunch and ask them for their tips and tricks of the trade.

Take classes, read, and attend seminars.

Make lots of offers. The right price of anything out there is always more than what it’s worth. Make offers and don’t hesitate in negotiating.

Jog, walk or drive a certain area once a month for 10 mins. (For real estate)

Shop for bargains in all markets.

Look in the right places.

Look for people who want to buy first. Then look for someone who wants to sell.

Think big. Work with many minds and stop being arrogant that you can do everything by yourself. People need other people.

Learn from history.

Action always beats inaction.

In the last section of the book, the author shares what it takes to be financially independent. It means being able to convert earned income(where we work to earn money and in which we are taxed a lot) into passive and portfolio income (where our money works hard in making more money).

He encourages the readers to learn the difference between the different types of incomes and how to change them. He also motivates us to read his other books if we wish to gain more knowledge and experience the CASHFLOW game for ourselves at www.richdad.com.

What are your thoughts on getting wealthy? What do know about financial independence, have you achieved it yourself or do you know someone who has? If you’re interested in finance, what piqued your curiosity? Let me know in the comments below.